A Compelling Private Credit Solution for Income-Focused Investors

Education from Golub Capital

Raising the Bar in Private Credit Education

Explore Golub Capital ’s Education Platform

GCRED seeks to deliver attractive risk-adjusted returns in the form of current income and capital appreciation by investing in a diversified portfolio of directly originated loans of U.S. middle market and upper middle market private companies.

GCRED is a non-traded business development company externally managed by GC Advisors LLC, an affiliate of Golub Capital.

Why GCRED

- Provides access to Golub Capital’s award-winning private credit platform

- Invests predominantly in first lien, senior secured, floating rate loans

- Fund structure designed for income-focused investors

Fund Features

- Accessible Investment Structure2

- Anticipated Quarterly Liquidity3

- Targeted Monthly Distributions and from time to time Variable Special Distributions*

- Attractive Fees4

- Tax Efficiency5

- Form 1099 Tax Reporting6

* There is no assurance we will pay distributions in any particular amount, if at all. Any distributions we make will be at the discretion of our board of trustees. As a result, our distribution rates and payment frequency may vary from time to time and are not guaranteed. We may fund any distributions from sources other than cash flow from operations, including, without limitation, the sale of assets, borrowings, return of capital or offering proceeds, and we have no limits on the amounts we may pay from such sources. Distributions have been and in the future may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Investment Adviser or its affiliates, that may be subject to reimbursement to the Investment Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled.

Why Golub Capital

Invest with a market-leading specialist in U.S. private credit with a track record of consistent returns across market cycles.

Capital Under Management7

Experience

Loans Originated Since 2004

Why Private Credit

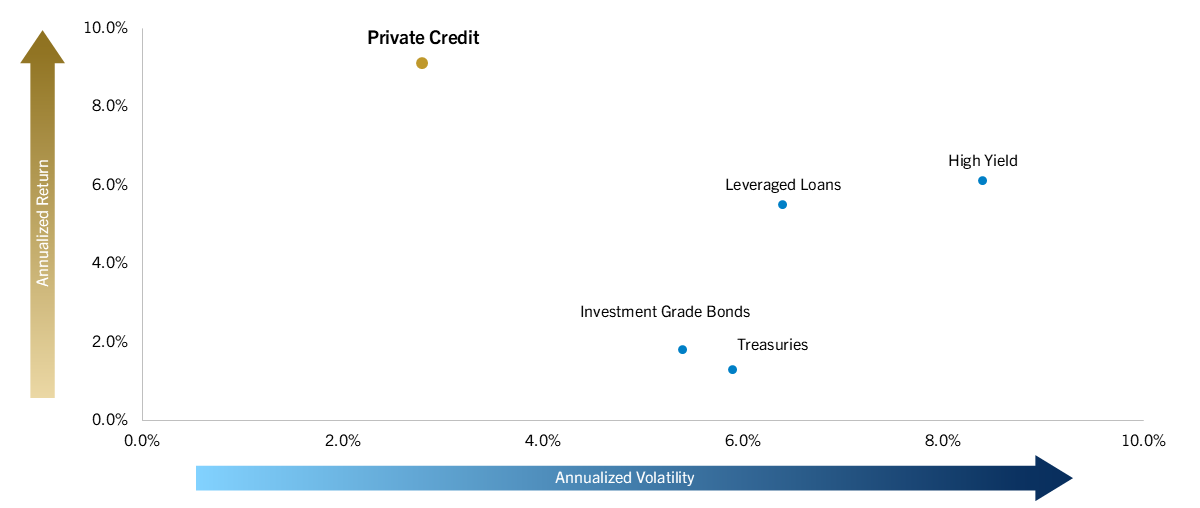

Private credit has offered attractive risk-adjusted returns.

Annualized Returns and Volatility*: Private Credit and Traditional Fixed Income8

Q4 2015 – Q3 2025

Past performance does not guarantee future results. You cannot invest directly in an index, which also does not take into account trading commissions and costs. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income.

*The volatility and risk profile of the indices presented in this document is likely to be materially different from that of the Fund. In addition, the indices employ different investment guidelines and criteria than the Fund and do not employ leverage; as a result, the holdings in the Fund and the liquidity of such holdings may differ significantly from the securities that comprise the indices. The indices are not subject to fees or expenses and it may not be possible to invest in the indices. A summary of the investment guidelines for the indices presented are available upon request.

GCRED Performance Updates

Join Our Mailing List

Fill out the form below to receive email updates on fund performance.

GCRED Mailing List

*The Fund has received an exemptive order from the U.S. Securities and Exchange Commission that permits the Fund to issue multiple classes of Common Shares with, among others, different ongoing shareholder servicing and/or distribution fees.

Fund Features

1. As of January 31, 2026. Annualized Distribution Rate is calculated by multiplying the sum of (i) the last three monthly distributions per share and (ii) special distributions, if any, payable or paid by four, and dividing the result by the price per share of the month preceding the relevant three month period. Distributions are not guaranteed. While GCRED may seek a level distribution rate, GCRED’s distribution rates may be affected by numerous factors, including but not limited to changes in realized and projected market returns, fluctuations in market interest rates, fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in GCRED’s distribution rate or that the rate will be sustainable in the future. Past performance is not necessarily indicative of future results. Distributions have been and may in the future be funded through sources other than cash flow. See GCRED’s prospectus for additional information. Please visit GCRED’s website for notices regarding distributions subject to Section 19(a) of the Investment Company Act of 1940. We cannot guarantee that we will make distributions, and if we do we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital, or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources. As of January 31, 2026, 100% of inception to date distributions were funded from cash flows from operations and current estimates do not expect a return of capital. A return of capital (1) is a return of the original amount invested, (2) does not constitute earnings or profits and (3) will have the effect of reducing the basis such that when a shareholder sells its shares the sale may be subject to taxes even if the shares are sold for less than the original purchase price. Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Investment Adviser or its affiliates, that may be subject to reimbursement to the Investment Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled.

2. Certain states have additional suitability standards. See the Prospectus for additional information.

3. Quarterly tender offers to repurchase shares are expected, but not guaranteed. The board of trustees may amend, suspend or terminate share repurchases at its discretion.

4. GCRED charges a 1.25% management fee on net assets and an incentive fee of 12.5% of net investment income (subject to a 5.0% hurdle with a catch up on the income portion, paid quarterly) and 12.5% of realized gains net of realized and unrealized losses (paid annually). The median management fee charged by publicly traded BDCs is 1.5% on gross assets and the median incentive fee is 17.5% as a percentage of pre-incentive fee net investment income (source: SEC filings). The BDC peer group utilized by Golub Capital is the 15 largest publicly traded, externally managed BDCs by total balance sheet assets, excluding GBDC, Golub Capital’s public BDC, as of December 31, 2025. Golub Capital has selected this group of BDCs for comparison because the Firm believes that the group represents companies that have a similar structure and size as GBDC. You will bear substantial fees and expenses in connection with your investment.

5. GCRED has elected to be treated as a regulated investment company for U.S. federal income tax purposes.

6. Golub Capital does not provide tax advice. Investors should consult with their own advisors when considering an investment in any investment strategy.

Why Golub Capital

7. “Capital under management” is a gross measure of invested capital including leverage. As of January 1, 2026.

Why Private Credit

8. Past performance does not guarantee future results. You cannot invest directly in an index, which also does not take into account trading commissions and costs. Index returns reflect all items of income, gain and loss and the reinvestment of dividends and other income. Returns are measured by annualized returns, which are calculated based on quarterly returns. Annualized volatility is measured by standard deviation of quarterly returns. Data from September 30, 2015 (the CDLI launch date) through September 30, 2025. The indices used in this analysis are: Private Credit is represented by the CDLI; High Yield is represented by ICE BofA US High Yield Index. The ICE BofA US High Yield Index tracks the performance of dollar denominated below investment grade corporate debt publicly issues in the US domestic market; Leveraged Loans are represented by the Morningstar LSTA US Leveraged Loan Index. The Morningstar LSTA US Leveraged Loan Index is a market value-weighted index designed to measure the performance of the U.S. broadly syndicated leveraged loan market. The Morningstar LSTA US Leveraged Loan Index typically encompasses 90%-95% of the entire broadly syndicated leveraged loan market; Investment Grade Bonds are represented by Bloomberg US Aggregate Bond Index. The Bloomberg US Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. These major sectors are subdivided into more specific indices that are calculated and reported on a regular basis. Treasuries are represented by the ICE BofA U.S. Treasury Index. The ICE BofA U.S. Treasury Index tracks the performance of the U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market.

Important Disclosure Information

Certain countries have been susceptible to epidemics or pandemics, most recently Covid-19. The outbreak of such epidemics or pandemics, together with any resulting restrictions on travel or quarantines imposed, has had and will likely continue to have a negative impact on the economy and business activity globally (including in the countries in which GCRED invests), and thereby is expected to adversely affect the performance of GCRED’s investments. Furthermore, the rapid development of epidemics or pandemics could preclude prediction as to their ultimate adverse impact on economic and market conditions, and, as a result, present material uncertainty and risk with respect to GCRED and the performance of its investments or operations.

Summary of Risks

- We are a relatively new company with a limited operating history and there is no assurance that we will achieve our investment objective.

- The majority of our portfolio investments are valued using the investment’s fair value, as determined in good faith by our valuation designee, subject to oversight by our board of trustees, and, as a result, there could be uncertainty as to the value of our portfolio investments.

- Because subscriptions must be submitted at least five business days prior to the first calendar day of each month (unless waived), you will not know the net offering price per share at which you will be subscribing at the time you subscribe.

- You should not expect to be able to sell your common shares of beneficial interest (“Common Shares”) regardless of how we perform.

- You should not expect to have access to the money you invest for an extended period of time.

- We do not intend to list our Common Shares on any securities exchange, and we do not expect a secondary market in our Common Shares to develop prior to any listing.

- Because you should not expect to be able to sell your shares, you should not expect to be able to reduce your exposure in any market downturn.

- At the discretion of our board of trustees, we have commenced a quarterly share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity, among other significant restrictions. Our board of trustees may amend, suspend or terminate the share repurchase program upon 30 days’ notice, if it deems such action to be in our best interest and the best interest of our shareholders. As a result, we cannot guarantee that share repurchases will be made available each quarter.

- An investment in our Common Shares is not suitable for you if you need access to the money you invest.

- You will bear substantial fees and expenses in connection with your investment.

- Because the incentive fee is based on the performance of our portfolio, the Investment Adviser may be incentivized to make investments on our behalf that are riskier or more speculative than would be the case in the absence of such compensation arrangement.

- We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources. Any capital returned through distributions will be returned after the payment of fees and expenses.

- Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Investment Adviser or its affiliates, that may be subject to reimbursement to the Investment Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled.

- We use and expect to continue to use leverage, which will magnify the potential for loss on amounts invested in us.

- We invest in securities that are rated below investment grade by independent rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.

- Neither the U.S. Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Securities regulators have also not passed upon whether this offering can be sold in compliance with existing or future suitability or conduct standards including the ‘Regulation Best Interest’ standard to any or all purchasers.

- This website must be read in conjunction with the Prospectus in order to fully understand all the implications and risks of an investment in GCRED. This website is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the Prospectus. Prior to making an investment, investors should read the Prospectus, including the “Risk Factors” section therein, which contain the risks and uncertainties that we believe are material to our business’ operating results.

Forward-Looking Statement Disclosure

Certain information contained in this website constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words, or the negatives thereof. These may include financial predictions estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward‐looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Golub Capital believes these factors include but are not limited to those described under the section entitled “Risk Factors”, which are further described in the Prospectus, and any such updated factors included in GCRED’s periodic filings with the U.S. Securities and Exchange Commission, which will be accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this website and in the filings. Golub Capital undertakes no obligation to publicly update or review any forward‐looking statement, whether as a result of new information, future developments or otherwise.

Securities offered through Arete Wealth Management, LLC Member: FINRA/SIPC. Only available in states where Arete Wealth Management, LLC is registered. Arete Wealth Management, LLC is not affiliated with any other entities identified in this communication.

Index Comparison

The volatility and risk profile of the indices presented in this document is likely to be materially different from that of the Fund. In addition, the indices employ different investment guidelines and criteria than the Fund and do not employ leverage; as a result, the holdings in the Fund and the liquidity of such holdings may differ significantly from the securities that comprise the indices. The indices are not subject to fees or expenses and it may not be possible to invest in the indices. A summary of the investment guidelines for the indices presented are available upon request.