Portfolio

As of May 31, 2025

Portfolio Snapshot

Total Investments

$6.4 Billion1

Floating Rate

~100%2,3

Senior Secured

98%2

Average Loan-to-Value

42%4

Median EBITDA

$81 Million5

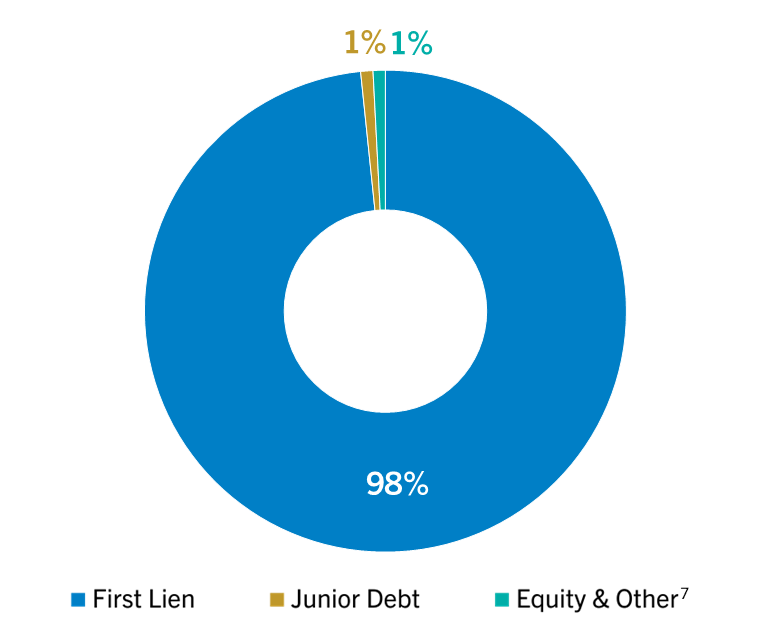

Asset Type Breakdown6

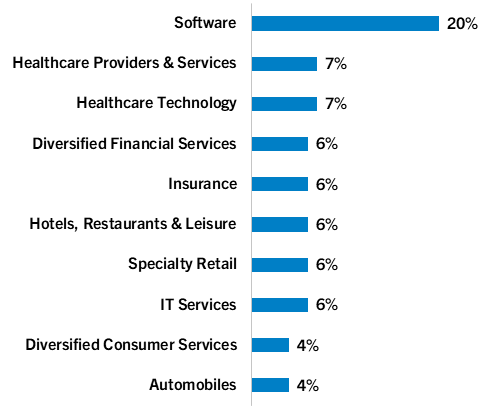

Top 10 Industries8

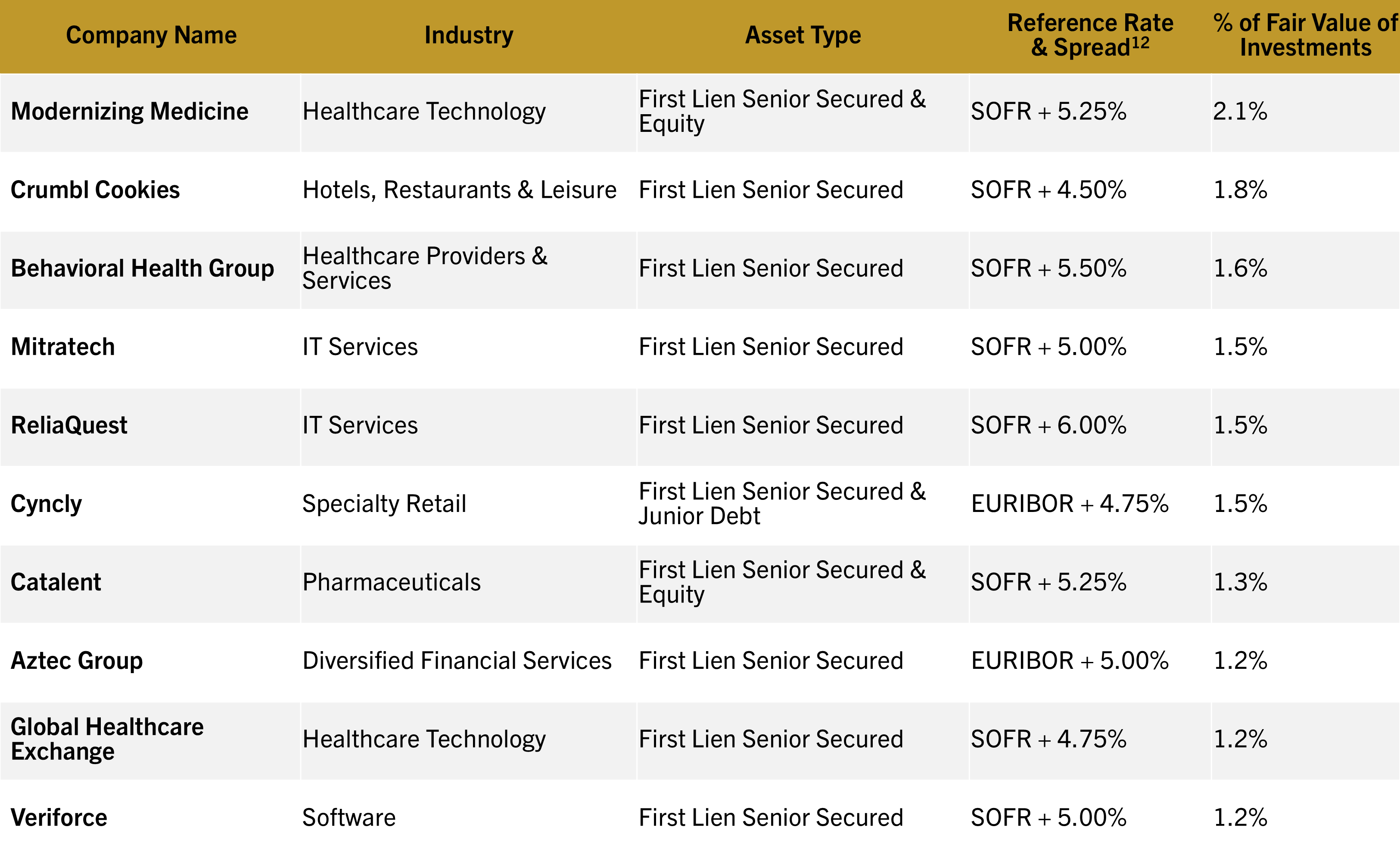

Top 10 Companies9,10,11

GCRED Literature & Resources

Join Our Mailing List

Fill out the form below to receive an email when updated literature and fund documents are available on our website.

To view the latest materials, please visit the Resources page.

GCRED Mailing List

1. Represents total investments at fair value. As of May 31, 2025.

2. As a percentage of debt investments in GCRED’s portfolio.

3. As of May 31, 2025, GCRED held five debt investments that represented an amount less than 1% of debt investments based on fair value that had a fixed interest rate.

4. As of March 31, 2025. Includes all private debt investments for which fair value is determined in good faith in accordance with the Fund’s valuation process, which includes the review of the valuation of each portfolio company, subject to a de minimis threshold, by an independent third-party valuation firm. Excludes quoted assets and recurring revenue loans. Average loan-to-value represents the ratio of loan-to-value for each portfolio company, weighted based on the fair value of total applicable GCRED private debt investments. Loan-to-value is calculated as the current total debt through each respective loan tranche divided by the estimated enterprise value of the portfolio company using the most recently received portfolio company information. Therefore, current enterprise value may not be up to date for certain portfolio companies. See GCRED’s Prospectus for additional information.

5. As of March 31, 2025. The portfolio median EBITDA (defined as earnings before interest, taxes, depreciation and amortization) is based on our portfolio of debt investments and excludes (i) portfolio companies with negative or de minimis EBITDA, (ii) investments designated as recurring revenue and broadly syndicated loans and (iii) portfolio companies with any loans on non-accrual status.

6. Measured as the fair value of investments for each category against the total fair value of all investments. Junior debt is comprised of second lien and subordinated debt. Totals may not sum due to rounding.

7. Other includes structured finance investments.

8. Based on S&P 2018 industry code. Measured as the fair value of investments for each category versus fair value of all investments.

9. All figures presented are as of May 31, 2025 unless otherwise indicated. Includes only data for GCRED’s ten largest portfolio companies based on fair value. Totals may not sum due to FRED rounding. Debt investments are shown as “Doing Business As” names. Please refer to the 10-K or 10-Q for actual borrower names.

10. The Secured Overnight Financing Rate (“SOFR”) is a measure of the cost of borrowing cash overnight collateralized by Treasury securities, which is published daily. Source: FRED.

11. The reference rate and spread for the largest tranche of debt outstanding at fair market value for each portfolio company is shown.

12. The Euro Interbank Offered Rate (“EURIBOR”) is a measure of the cost of borrowing cash between European panel banks, which is published daily. Source: Euribor Rates.

Important Disclosure Information

Certain countries have been susceptible to epidemics or pandemics, most recently Covid-19. The outbreak of such epidemics or pandemics, together with any resulting restrictions on travel or quarantines imposed, has had and will likely continue to have a negative impact on the economy and business activity globally (including in the countries in which GCRED invests), and thereby is expected to adversely affect the performance of GCRED’s investments. Furthermore, the rapid development of epidemics or pandemics could preclude prediction as to their ultimate adverse impact on economic and market conditions, and, as a result, present material uncertainty and risk with respect to GCRED and the performance of its investments or operations.

Summary of Risks

- We are a relatively new company with a limited operating history and there is no assurance that we will achieve our investment objective.

- The majority of our portfolio investments are valued using the investment’s fair value, as determined in good faith by our valuation designee, subject to oversight by our board of trustees, and, as a result, there could be uncertainty as to the value of our portfolio investments.

- Because subscriptions must be submitted at least five business days prior to the first calendar day of each month (unless waived), you will not know the net offering price per share at which you will be subscribing at the time you subscribe.

- You should not expect to be able to sell your common shares of beneficial interest (“Common Shares”) regardless of how we perform.

- You should not expect to have access to the money you invest for an extended period of time.

- We do not intend to list our Common Shares on any securities exchange, and we do not expect a secondary market in our Common Shares to develop prior to any listing.

- Because you should not expect to be able to sell your shares, you should not expect to be able to reduce your exposure in any market downturn.

- At the discretion of our board of trustees, we have commenced a quarterly share repurchase program, but only a limited number of shares will be eligible for repurchase and repurchases will be subject to available liquidity, among other significant restrictions. Our board of trustees may amend, suspend or terminate the share repurchase program upon 30 days’ notice, if it deems such action to be in our best interest and the best interest of our shareholders. As a result, we cannot guarantee that share repurchases will be made available each quarter.

- An investment in our Common Shares is not suitable for you if you need access to the money you invest.

- You will bear substantial fees and expenses in connection with your investment.

- Because the incentive fee is based on the performance of our portfolio, the Investment Adviser may be incentivized to make investments on our behalf that are riskier or more speculative than would be the case in the absence of such compensation arrangement.

- We cannot guarantee that we will make distributions, and if we do, we may fund such distributions from sources other than cash flow from operations, including the sale of assets, borrowings, return of capital or offering proceeds, and although we generally expect to fund distributions from cash flow from operations, we have not established limits on the amounts we may pay from such sources. Any capital returned through distributions will be returned after the payment of fees and expenses.

- Distributions may also be funded in significant part, directly or indirectly, from temporary waivers or expense reimbursements borne by the Investment Adviser or its affiliates, that may be subject to reimbursement to the Investment Adviser or its affiliates. The repayment of any amounts owed to our affiliates will reduce future distributions to which you would otherwise be entitled.

- We use and expect to continue to use leverage, which will magnify the potential for loss on amounts invested in us.

- We invest in securities that are rated below investment grade by independent rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value.

- Neither the U.S. Securities and Exchange Commission nor any state securities regulator has approved or disapproved of these securities or determined if the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense. Securities regulators have also not passed upon whether this offering can be sold in compliance with existing or future suitability or conduct standards including the ‘Regulation Best Interest’ standard to any or all purchasers.

- This website must be read in conjunction with the Prospectus in order to fully understand all the implications and risks of an investment in GCRED. This website is neither an offer to sell nor a solicitation of an offer to buy securities. An offering is made only by the Prospectus. Prior to making an investment, investors should read the Prospectus, including the “Risk Factors” section therein, which contain the risks and uncertainties that we believe are material to our business’ operating results.

Forward-Looking Statement Disclosure

Certain information contained in this website constitutes “forward-looking statements,” which can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue” or other similar words, or the negatives thereof. These may include financial predictions estimates and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, and statements regarding future performance. Such forward‐looking statements are inherently uncertain and there are or may be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. Golub Capital believes these factors include but are not limited to those described under the section entitled “Risk Factors”, which are further described in the Prospectus, and any such updated factors included in GCRED’s periodic filings with the U.S. Securities and Exchange Commission, which will be accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this website and in the filings. Golub Capital undertakes no obligation to publicly update or review any forward‐looking statement, whether as a result of new information, future developments or otherwise.

Securities offered through Arete Wealth Management, LLC Member: FINRA/SIPC. Only available in states where Arete Wealth Management, LLC is registered. Arete Wealth Management, LLC is not affiliated with any other entities identified in this communication.

Index Comparison

The volatility and risk profile of the indices presented in this document is likely to be materially different from that of the Fund. In addition, the indices employ different investment guidelines and criteria than the Fund and do not employ leverage; as a result, the holdings in the Fund and the liquidity of such holdings may differ significantly from the securities that comprise the indices. The indices are not subject to fees or expenses and it may not be possible to invest in the indices. A summary of the investment guidelines for the indices presented are available upon request.